🎮 The Business Game Walkthrough: Level 2 – The Payroll Puzzle

Welcome back, player! In Level 1, we established that VAT is a high-impact, high-risk variable. Now, in Level 2, we turn our attention to Payroll Taxes (Income Tax and National Insurance Contributions – NICs).

In the Dryden model, payroll is crucial, contributing nearly

70% of the total tax collected by the government (about £18 million out of £26 million) due to our large £11 million wage bill. Adjusting this area is highly consequential for both Dryden’s survival and the government’s tax take.

The Baseline: The “Muddling Through” Scenario (VAT @ 20%)

We start with the “prudent management” outcome from Level 1, using current UK tax settings (VAT 20%, Corp Tax 25%). This is the baseline where the business owner just about hits their wealth target, but the business remains stagnant.

Level 2 Challenge 1: The Payroll Tax Hike (+2%)

What happens if Payroll Taxes increase by 2% (e.g., higher NICs)?

Result: Zombie Business. The additional staff cost from the 2% payroll tax hike hits the bottom line hard. The business capital is now flat by Year 5 (£1.22 million). The business is unable to build capital, cannot grow, and risks falling “hostage to the lender not willing to refinance” its debt. The business owner is unlikely to risk taking the large dividend in Year 5.

Level 2 Challenge 2: The Payroll Tax Cut (-2%)

What happens if Payroll Taxes decrease by 2%?

Result: Sustainable Growth . This relatively small tax cut is crucial. The company can now grow its capital base beyond £2 million and, significantly, there is no need to reduce staff headcount. The business is no longer a “zombie business” and has the buffer required to withstand shocks and look towards growth.

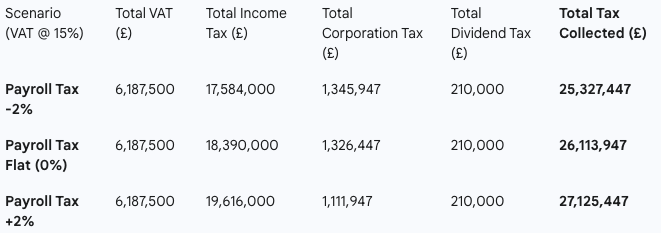

Profitable Business Scenario (VAT @ 15%)

When we move to a scenario where the business is more profitable (by setting VAT to 15%, as per Level 1), the impact of payroll tax changes shifts:

- Tax Hike (+2%): A 2% payroll tax increase is comfortably absorbed by a profitable company. The main impact is a slower rate of capital accumulation (about £800k less capital after 5 years).

- Tax Cut (-2%): A 2% payroll tax reduction allows the company to immediately increase hiring by 2% (from 215 staff to 220 in Year 1) while achieving a similar financial position.

The Final Tax Calculation: Payroll’s Role

If the government increases payroll tax, it collects more direct revenue, but what are the side effects?

Insight: For profitable businesses, a 2% payroll tax increase adds around £1 million in tax collected. However, this gain comes at a cost:

- Lower Corporation Tax: The higher payroll costs mean lower profits, thus lower Corporation Tax is collected.

- Dampened Employment: The tax increase may mean the business reduces staff hiring by about 2% compared to the tax cut scenario. This lost employment creates a societal cost for the government.

The lesson from Dryden is clear: for businesses that are “just surviving” (like Outcome 1B), increasing payroll tax can instantly push them into a troubling, unsustainable situation. For businesses near the margin, a high tax burden leaves them unstable to shocks and often necessitates government bailouts later on.

The Real-World Impact

- Hospitality Sector Failure: The UK hospitality sector struggles because many of these low-margin businesses operate in the “just surviving” zone (like our 20% VAT scenario). The recent national insurance (payroll tax) increases push these already fragile companies into financial distress, leading directly to a large number of layoffs and closures.

- JLR Supply Chain Vulnerability: The JLR supply chain crisis provides a clear warning for businesses that have not built up financial buffers. Many suppliers to JLR stated they lacked the resources to survive a shock like a factory shutdown. Businesses that are in the “zombie business” state—due to high tax burdens preventing capital growth—are extremely vulnerable to insolvency when faced with sudden shocks.

The core lesson remains: high tax burdens drain the private sector’s ability to build capital buffers. This lack of resilience in low-margin, high-employment sectors means that governments often need to intervene later with bailouts, offsetting the tax revenue they gained upfront.