🎮 The Business Game Walkthrough: Level 3 – The Corporation Tax Conundrum

Welcome to the final level of our initial walkthrough! You’ve navigated the high-stakes decisions of VAT (Level 1) and Payroll Taxes (Level 2). It’s time for the capstone: Corporation Tax.

Level 3 Challenge: Does Corporation Tax Even Matter?

In a slight anti-climax, you likely noticed that

Corporation Tax (CT) doesn’t seem to impact Dryden that much. Changing the rate from 25% to 15% might only alter the total business capital by around £100,000 over five years —barely enough to hire a single new person.

This low impact is because Dryden is not consistently highly profitable, and CT is only applied to profit. When the business is barely making a profit, a 25% tax rate on that small profit has a negligible effect on the company’s long-term health.

Scenario: Surviving the Recession (VAT @ 20%, Payroll +2%)

Result: The Critical Buffer

Now, let’s see the effect of lowering Corporation Tax from 25% to a hypothetical 15% in the exact same economic scenario:

Result: The Safety Net. The extra capital built up by the lower tax rate (CT 15% vs. CT 25%) is crucial. It gives the business a buffer of an extra

£100k. For the vulnerable

JLR suppliers or any low-margin business, this small extra buffer can mean surviving for an extra six to twelve months, potentially allowing them to weather the recession.

Corporation Tax and Total Tax Collected

In the profitable scenario (VAT 15%, flat Payroll Tax), let’s compare the tax collected when we assume Dryden uses the extra capital from the CT cut to hire new staff.

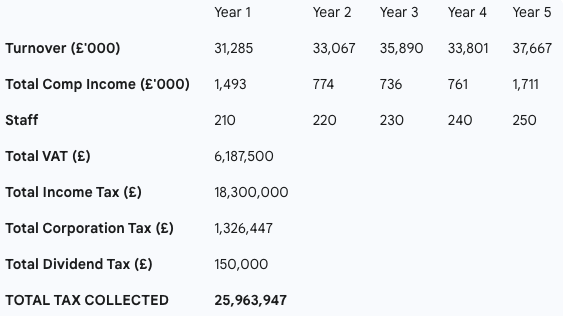

Scenario 1: High CT (25%) with Fixed Staff Growth (10 per year)

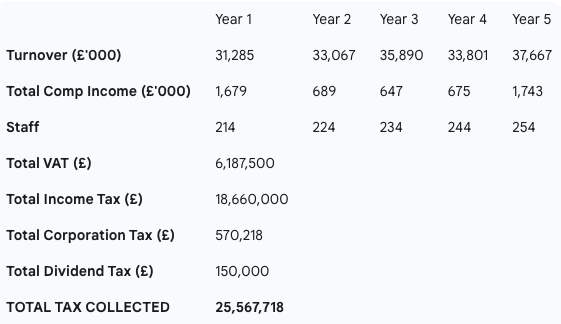

Scenario 2: Low Corporation Tax (15%) with Accelerated Staff Growth (2 extra staff/year)

Conclusion: Reducing Taxation May Increase Tax Collection

The difference in total tax collected between the two scenarios is small—about £400k. This £400k difference is roughly the cost used to hire the four additional staff (from 210 to 214) in the first two years of the 15% CT scenario.

- The Government’s “Loss”: The government sees a drop in Corporation Tax revenue.

- The Economy’s Gain: Dryden has more employees who are now spending their wages elsewhere in the economy. This increased spending generates higher revenue for other companies, leading to additional tax collection (VAT, Income Tax, and Corporation Tax) across the economy.

- The final result is that the £400k difference will likely disappear as the growth from the private sector generates more tax revenue. A lower CT rate is better for business growth, R&D, and overall employment.

Game Over: The Laffer Curve Warning

After playing all three levels, the fundamental lesson is that tax has significant impacts on a business’s resilience, ability to grow, and hiring capacity.

The government operates on the principle of the Laffer Curve: a 0% tax rate yields no revenue, and a 100% tax rate yields no revenue. The ideal rate sits somewhere in the middle, but our simulation suggests that current tax levels are far beyond the “optimal tax rate for business growth”. Governments wanting more tax shouldn’t blindly increase rates, as this simply drags down business. The biggest problem in financial modelling is averaging, which encourages tax increases by ignoring the potential upsides of reinvestment and the rapid staff reductions driven by micro-tax pressures.