💡 UK Capital Markets Reboot: Should Property Fund Innovation?

This paper proposes a strategy to revitalise the UK’s capital markets by redirecting significant wealth from investment properties into the technology sector, addressing a critical shortage of equity investment for promising technology start-ups.

The proposal is based on the following assumptions:

- The UK suffers from a chronic shortage of equity investment for promising technology start-ups.

- The UK’s investment profile is heavily overweight property.

- Capital accumulated in investment properties is effectively trapped due to Capital Gains Tax (CGT).

The Capital Imbalance

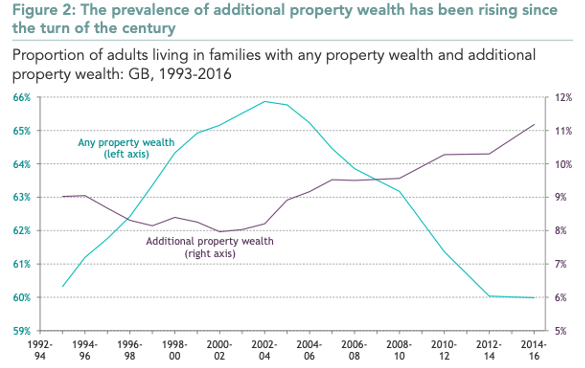

To illustrate the stark difference in investment focus, the UK has accumulated well over £1 trillion in wealth from investment properties. The Resolution Foundation noted this figure was £1 trillion in 2016, and the market has increased by a further 50% since then.

In contrast, the London IPO fundraising market has fallen to a 30-year low, with companies raising just £160 million in the first half of 2025.

The Trap of Capital Gains Tax (CGT)

There is a huge amount investment property wealth which is trapped. With investment property prices often doubling or tripling over the last 20 or 30 years, many mostly older Baby Boomer owners find it unattractive to sell. They don’t want to lose a big chunk of wealth to capital gains tax with potential inheritance tax to follow.

The issue is the effective tax rate when selling:

- Assuming property prices have doubled and CGT is at the higher rate of 24%, the investor would pay away 12% of the total sale proceeds in CGT.

- If the investor had 50% mortgage financing (leverage) and the property prices doubled over 10 years, the effective CGT rate jumps to 16% of the total capital after repaying the loan.

Given their age and desire to pass wealth to family, many property investors find it more rational to hold onto the property until inheritance. This is because waiting avoids the risk of double taxation, where CGT is paid, and then Inheritance Tax is due on the estate and proceeds. As a result, properties and investment capital are not being recycled. This lack of recycling contributes to property shortages, higher home prices, and stagnation in redevelopment.

Capital Markets Reboot: The Proposition

The solution is to encourage property investors to voluntarily move their capital from investment properties to technology investments.

This can be achieved by:

- Shielding property investors from Capital Gains Tax on the sale of their investment property if and only if these funds are immediately moved into an approved technology investment fund.

- These funds would be used to support UK Initial Public Offerings (IPOs) and technology investments.

- A minimum holding period of 2 years would be required for the technology investment.

Assessment of the Proposition

This approach offers several powerful outcomes:

- Massive Injection of Capital: If just 5% of the estimated investment property wealth is moved, this would unlock approximately £50 billion in technology funding. This significantly surpasses the £25 billion target from Megafunds discussed in the Mansion House Accord.

- Downside Protection: The CGT shield essentially provides a 12% to 16% subsidy to the property investors (the tax they avoid), which acts as a built-in downside protection against the riskier nature of Technology IPOs. This directly addresses a primary reason for low technology investment: the fear of losses.

- Market Liquidity and Revenue: The policy is expected to lead to increased property market liquidity and likely result in increased Stamp Duty receipts.

- Minimal CGT Loss: Since many of these properties are currently held until inheritance to avoid double taxation, the loss of CGT collected is expected to be minimal.

- Acceleration of Capital: This is primarily an acceleration of capital movement from the stagnant property sector to the high-growth technology sector. It uses tax as downside protection, not merely a relief on future gains.